By Kelly Pickerel | October 13, 2022

Advisory firm Clean Energy Associates (CEA) has released its latest market intelligence report that reviews the status of solar panel manufacturing on a global scale. The full “Q2 2022 PV Supplier Market Intelligence Program Report (SMIP)” is available via subscription.

Among the findings in this quarter’s report is the technology trend of suppliers shifting focus to TOPCon and HJT solar, which will increase efficiency levels of solar panels. This is leading to more expansions in the solar cell manufacturing space to supply the need for updated cells with the latest technologies.

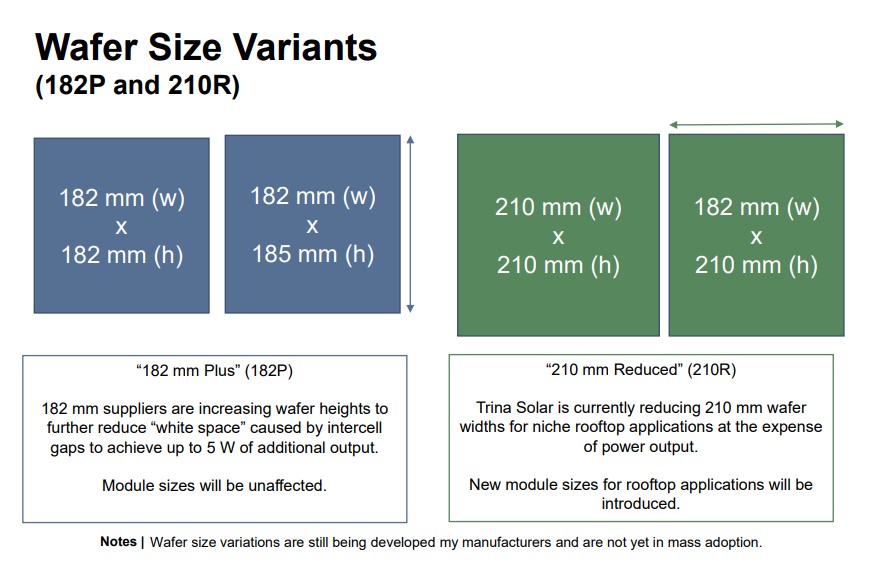

On the manufacturing side, suppliers are exploring ways to optimize wafer sizes after standardizing 210-mm (G12) and 182-mm (M10) module dimensions. The “182-mm Plus” (182P) has increased wafer heights to further reduce “white space” caused by intercell gaps to achieve up to 5 W of additional output. Module sizes should be unaffected. The “210-mm Reduced” (210R) has reduced wafer widths for niche rooftop applications at the expense of power output. New module sizes for rooftop applications will be introduced.

CEA maps out global solar supply chain capacities within the report, including:

- Six polysilicon facilities are expected to fully ramp up production this quarter, bringing Q3’s total global available polysilicon manufacturing nameplate to 90 GW. End-of-year polysilicon capacities are expected to reach 295 GW in 2022 (after accounting for factory maintenance) and up to 536 GW in 2023 (assuming all projects in the pipeline develop as planned).

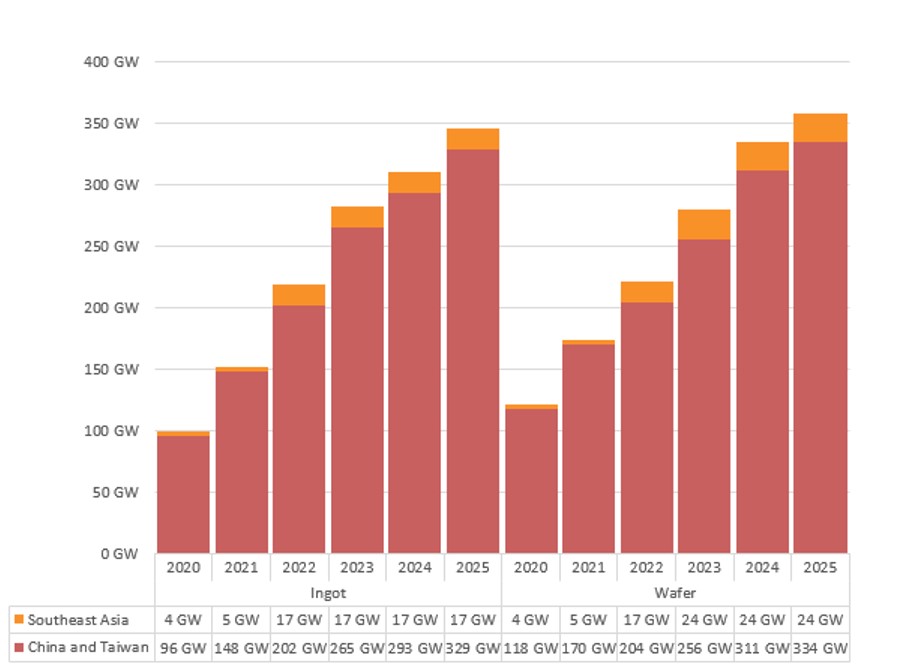

- Ingot capacity grew almost 30 GW this quarter, primarily due to another 23 GW coming online at two facilities.

- Wafer capacity decreased slightly, primarily due to a supplier retiring its multi-crystalline wafer capacity.

- The 17 PV suppliers covered in the report increased total cell capacity by 22% in Q2 2022 alone, bringing an additional 47 GW of capacity online to reach a total of 262 GW this quarter.

- Module production capacities in Q2 2022 reached over 324 GW, and by the end of 2022 are forecasted to reach nearly 400 GW, up approximately 20% from current capacities.

SMIP Supplier Ingot And Wafer Capacities (GW end-of-year capacity estimates)

Suppliers covered by the report currently operate 11 GW of non-China ingot capacity, 42 GW of non-China cell capacity, and nearly 50 GW of non-China module capacity. They maintain plans to increase these capacities to 23 GW, 73 GW, and 74 GW, respectively. Almost all suppliers have realized non-China upgrade plans for large wafers; only a few suppliers migrating to the 210-mm format need additional time to finalize expansion plans due to the need for more costly equipment purchasing/upgrading.

CEA reports that policy uncertainty continues to defer expansion plans in the United States.

News item from CEA

Post time: Oct-17-2022